-

8Manage FAS Work In Progress (WIP) Financial Management

Work In Progress (WIP) Financial Management is the real-time finance connectivity to your WIP workflows in demand chain, project portfolio, production and supply chain. WIP Financial Management can provide you the incremental view on work progress, resource consumption, time & cost consumption and revenue earning at any given time. Without this complete and just-in-time information, it would be hard for you to determine estimation-to-complete with your newly devised methods even you have above-average experience in the field. Many projects go wrong over and over again because they are vague in their status quo. In other words, WIP Financial Management is the key in decision support -- no good information, no good decisions.

-

Financial Management with Business Connectivity

The common weakness in most financial management systems today is their lack of connectivity to business activities and the information is entered into the systems after the facts by humans. If these financial management systems were designed with tight connectivity with real-life business activities such as the automated teller machine(ATM) systems were designed to cater, the agility and accuracy of the information provided by most financial management systems today would have been much better.

The designs of the existing financial management systems were heavily influenced by the bookkeeping practices of manually entering information into the financial book or spreadsheets after the facts. It was naturally to think and design systems that way when humans didn’t have sufficient experience in real-time finance connectivity more than a decade ago.

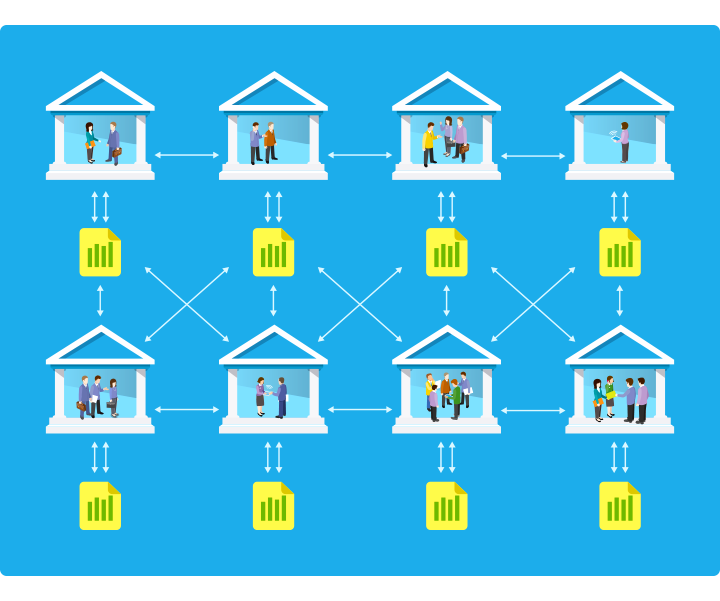

With the advancement in trading systems technology such as Straight Through Process (STP) and cryptocurrency technology such as blockchain, humans gradually have gained sufficient experience to design financial management systems that have much higher finance connectivity to real-life business activities. FAS was designed with high finance connectivity in mind. Using FAS, the user can view consolidated or individual real-time reports such as Income Statement, Balance Sheet and Cash Flow of an enterprise or any of its many legal entities, business units and cost centers across multiple countries in real-time. We arent talking about generating Income Statement with detailed profit and loss information every month or week, but every hour or minute. -

Generate Income Statement, Cash Flow Report Every Hour

Even low-end PC today has sufficient computing power to generate Income Statement, Account Receivable, Account Payable and Cash Flow reports for an enterprise every day or every hour. The only reason that an enterprise can’t generate the up-to-date reports every day, week or even month because it lacks financial connectivity in its business and operational processes. The manual interaction model that people accustom to prohibits the financial connectivity even the modern computer hardware and software are geared to provide the level of connectivity needed for agile financial information.

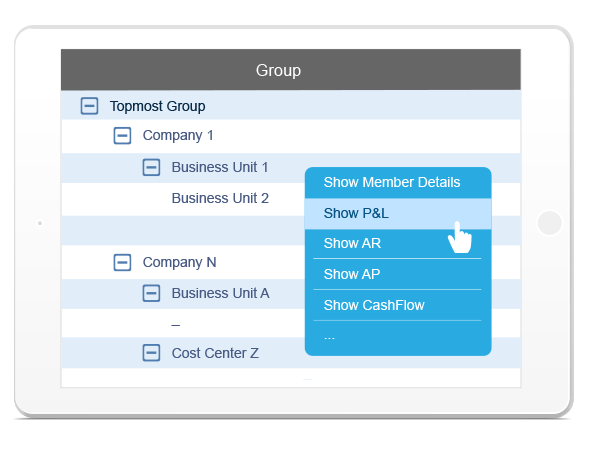

Using the FAS financial connectivity model, an executive is allowed to view any of the financial reports mentioned above of any unit/company/group in real-time.

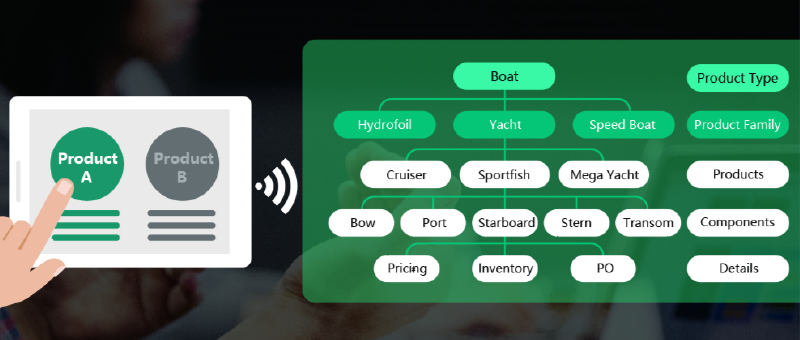

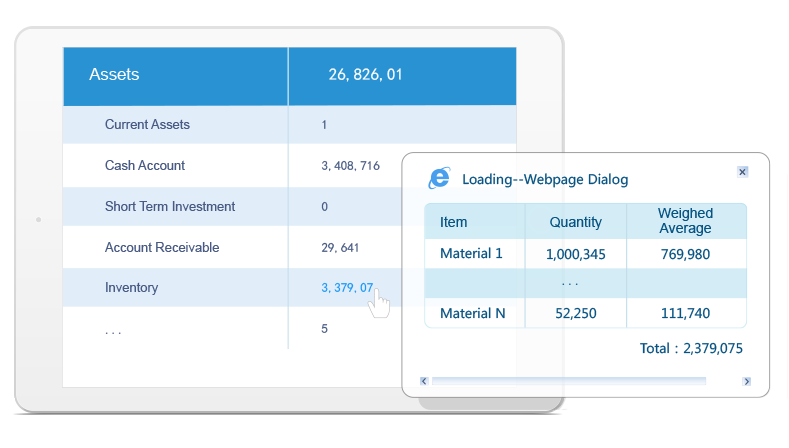

The system will automatically aggregate from lowest units/companies/groups to the highest level units/companies/groups in real-time and automatically eliminate inter-company transactions at the same time. Besides fast generation of financial information, the system also allow real-time drill down of information.

For example,one can click the underlined inventory number in the balance sheet and the system will show the inventories that make up the number.

This type of financial connectivity is not only possible but actually easier and less costly to implement than the manual interaction model that people accustom to.People should change the manual interaction model that they accustom to and take advantage of the modern computer hardware and software to do their job better. -

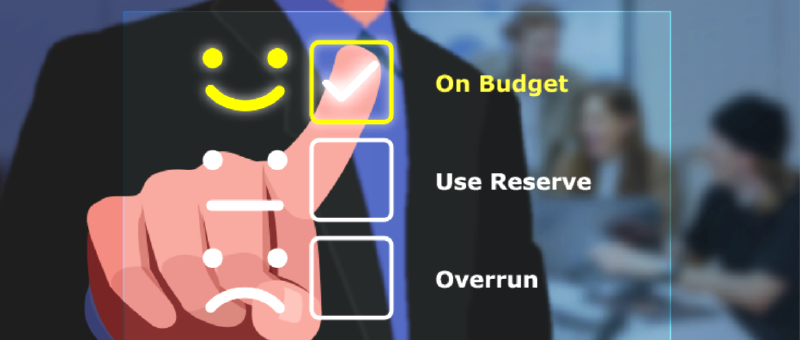

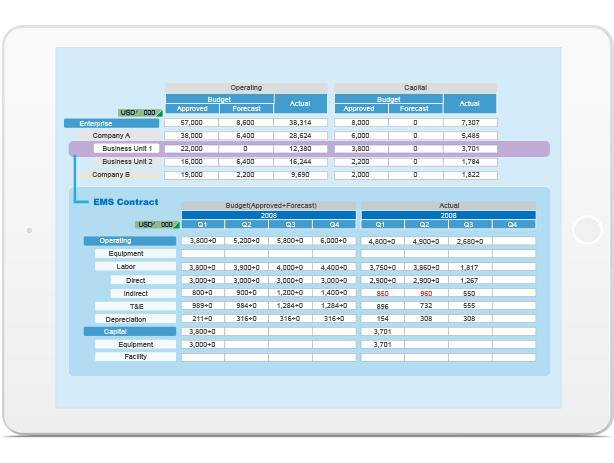

Budget & Expense Management

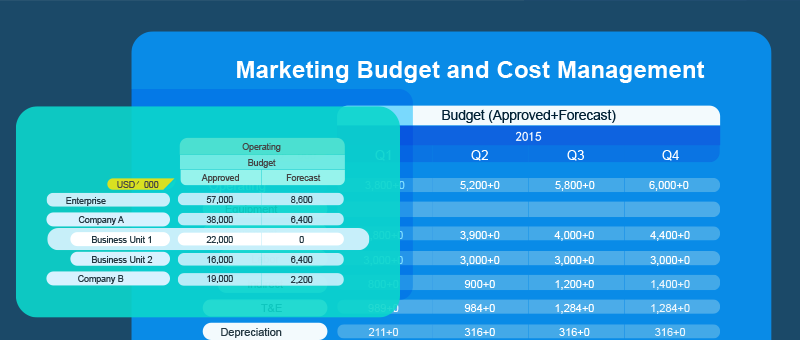

FAS provides organizational Revenue & Cost Budgeting & Tracking capabilities to ensure the assembly and dissemination of information across organizational units and legal entities in real-time. An organizational units Revenue and Cost Budgeting and Tracking is linked to its sales orders and contracts, purchase orders, project accounting, staff planning and cost, invoices, expense reports and payments. The budgeted and actual numbers always reflect the latest reality and the user can click through the numbers and view the items compose them in real-time.

-

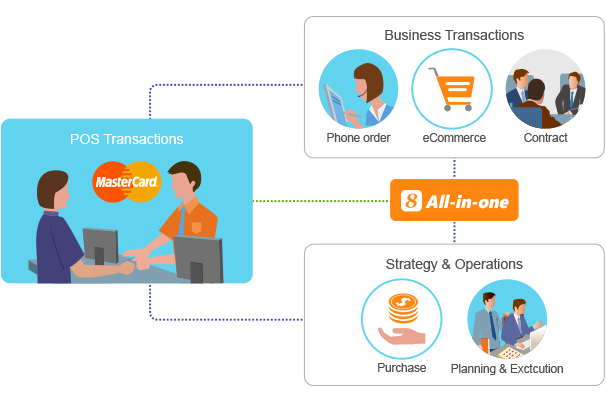

Sales Revenue Connectivity

FAS can establish high connectivity to the real-life sales activities using the following transaction models:

- Retail transactions captured by Point of Sales (POS) systems

- Retail or wholesale transactions captured in sales orders (including phone & eCommerce orders)

- Retail or wholesales transactions captured in sales contracts

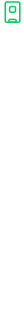

All sales transactions can be captured in real-time and information will be immediately available to financial operations and business departments for planning & execution purposes. The sales transaction information will be automatically linked to the sales finance management practices that the financial operations and business departments have chosen to use such as below:- Revenue planning and quota management by individual group, sector/region and enterprise

- Opportunity finance and pipeline management

- Repeated revenue management

Re-forecasts (e.g., 2+10, 3+9,… , 11+1) can be automatically done based on the formulas already setup.

-

Marketing Finance Connectivity

Marketing strategies should be creative but must have built-in reality checks to guide their execution. Built-in reality checks can include things such as eSurvey and incremental return management FAS embeds financial connectivity in its following marketing management models:

- Marketing budget planning & tracking

- Campaign (including eDM and eSurvey) management

- Marketing return management

With embedded marketing finance connectivity, FAS can help executives and marketing managers to track detailed return in terms of leads, qualified leads, referrals, increased POS transaction amount, new order/contract revenue amount and improved brand name recognition based on before and after eSurveys. -

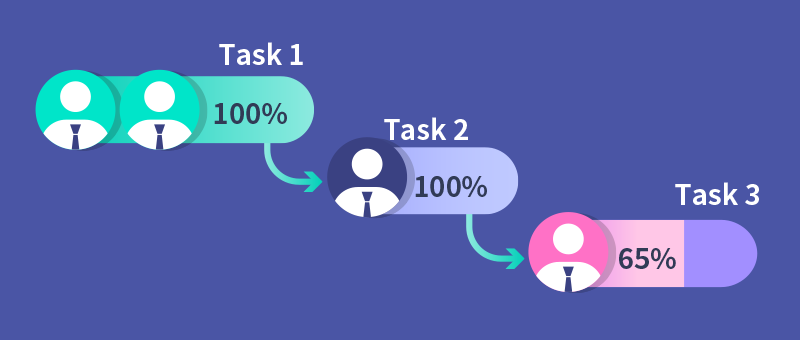

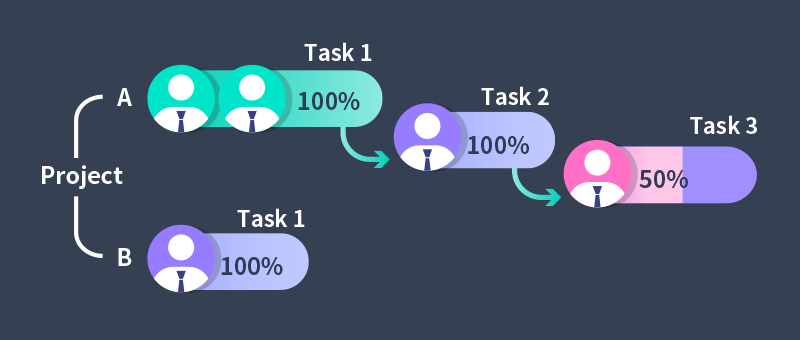

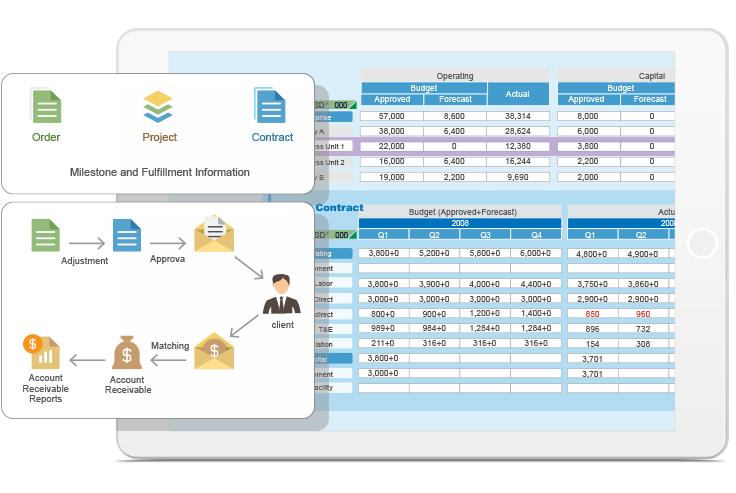

Project Finance Connectivity

Project finance management can be very simple if what budgeted by whom and what consumed by whom in a project can easily be seen in real-time. But the fact is that most projects have multiple activities sharing the same budget and couldn't distinguish which activities are accountable for the overrun. This is further complicated by the delay of timesheet, purchase and expense processing across multiple groups involving multiple currencies.

Project finance management is also greatly affected by the project scope and time changes. If one can't control the project scope and time well, one can't control the project finance well.

FAS allows budgeting and tracking in project, high level activities and low level activity levels and finance information will be automatically aggregated from the lowest level to the highest level in real-time. Timesheets, purchase orders, outsourcing invoices and expense reports are processed in real-time and labor and procurement costs are automatically calculated in real-time.

FAS has built-in finance connectivity not only in project activities, resources and deliverables but also in project scope items and schedules.

With built-in finance connectivity, any change to the project that would affect the project finance will be automatically tracked and information will be highlighted so that people would understand the change impact. The above approach solves the following key most problems in project management:- Things are too much intermixed together and the financial impact for the change is unclear to all parties and therefore people often naively request many changes and naively accept many changes.

- Financial information is too sluggish and people find project budget overrun 2 to 3 months after the actual overrun occurs.

- Some project managers put a lot of financial cushion in their projects and this often doesn’t work since the reserve is limited and the lack of control in scope, time and change can generate the impact that is bigger than the reserve.

FAS solves the above problems by helping project stakeholders to calculate well by utilizing its build-in finance connectivity in project management

-

Procurement Finance Connectivity

FAS supports the entire procurement process and with real-time financial connectivity. Departmental budget is well integrated with purchase plans and orders and invoices, payment requests, payments and returns are well integrated with departmental account payable and actual expenditure. Purchase orders will not be approved if the responsible department doesn’t have sufficient budget and outstanding payments will be reflected in account payable once invoices and payment requests are approved.

FAS allows the establishment of the benchmark prices of products based on their historical prices and CPI adjustments. The benchmark prices are used to control the significant derivation from the price norms. In FAS, each supplier is being measured in real-time its cumulative price derivation from the corresponding benchmark prices. Each purchase order is being measured in real-time its total derivation from the corresponding benchmark prices. And each purchase item is being measured in real-time its derivation from the corresponding benchmark price. The procurement department can be easily see which requestor or procurement person has the highest derivation for single purchase or the highest cumulative derivation year-to-date. -

Inventory Accounting Connectivity

FAS help manage raw materials, work-in -process materials and finished products which need to be ordered, stored, processed and transferred to and in multiple sites and warehouses. FAS is a multi-currency system and provides the following features and financial connectivity throughout:

- Demand forecasting

- Purchase plan and purchase order

- Logistics cost calculation

- Receipt of goods

- Return of goods to supplier

- Serial number tracking

- Warranty & expiration tracking

- Material request, approval and delivery

- Stock transfer and tracking

- Inventory counting & update

-

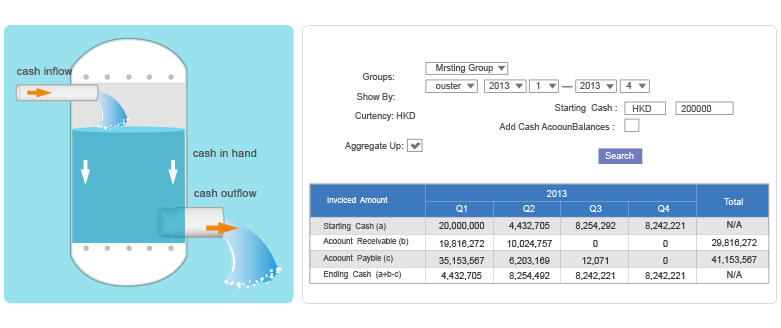

Cash Flow

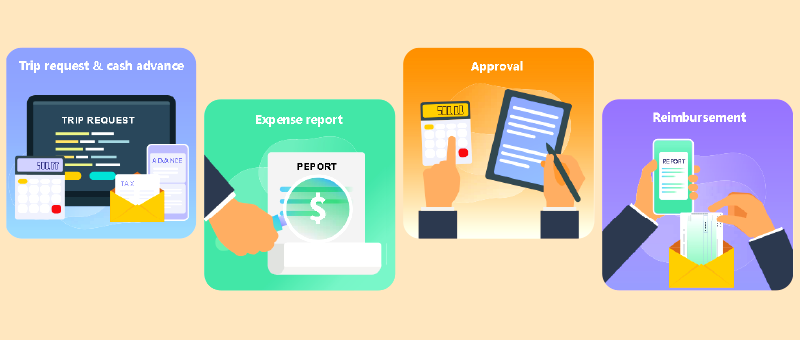

FAS tracks all sales orders/contracts, purchase orders/contracts, project accounts, employee payroll and tax accounts, invoices, expense reports, and payments of each organizational unit and aggregate information to generate cash flow report for the period and organizational structure that the user requests in real-time.

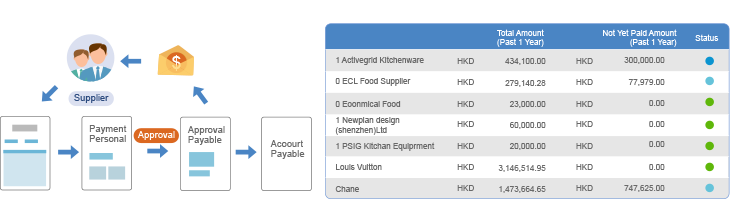

FAS allows the user to track invoices received, generate payment requests and obtain the proper approvals. The approved payment requests will be automatically forwarded to the account payable for payments. FAS can also generate various accountable payable reports in real-time.

FAS allows the user to track sales order fulfillment statuses, project progresses and contractual payment terms to generate invoices to bill clients. Integration with front-line project management and delivery systems and automated workflow notifications accelerate billing process to improve cash performance across the enterprise.